Why Emotional Intelligence is Your Most Undervalued Asset

- VangaVault Team

- 20 hours ago

- 5 min read

In the race to automate, digitize, and streamline, the modern enterprise has engineered a fatal flaw into its operating system: it has optimized for transaction speed at the expense of relationship depth.

We have spent the last decade deploying billions into CRM stacks, AI chatbots, and omnichannel analytics, all designed to reduce friction. Yet, customer loyalty has never been more fragile. The reason is simple: we confused "efficiency" with "service."

Efficiency is the mechanics of the transaction. Service is the psychology of the interaction.

The market reality is stark. According to McKinsey, 70% of the customer's buying experience is based on how they feel they are being treated. In an economy where competitors can replicate your product features in weeks and your pricing models in days, your last defensible moat is the emotional connection you hold with your market.

This is the "Empathy Arbitrage." While your competitors view support as a cost center to be minimized, the strategic leader views it as a revenue generator to be maximized. This article outlines the governance framework required to operationalize empathy—transforming it from a "soft skill" into a hard asset that drives Net Dollar Retention (NDR) and protects enterprise value.

The Financial Mechanics of "Feeling"

To command the attention of the Board, we must strip the sentimentality out of empathy and look at the math.

The traditional P&L views customer service labor as an expense line—a necessary evil. This view ignores the Service Recovery Paradox. This economic principle states that a customer who encounters a failure but receives a highly empathetic, effective resolution is often more loyal and profitable than a customer who never experienced a failure at all.

However, the inverse is also true. The "Double Deviation" effect occurs when a service failure is followed by a failed recovery (usually due to a lack of empathy or rigid scripting). This triggers a disproportionate acceleration in churn.

Data reinforces this financial impact. Research shows that customers are 2.4 times more likely to stick with a brand when their problems are solved quickly, but the loyalty multiplier explodes when they feel understood.

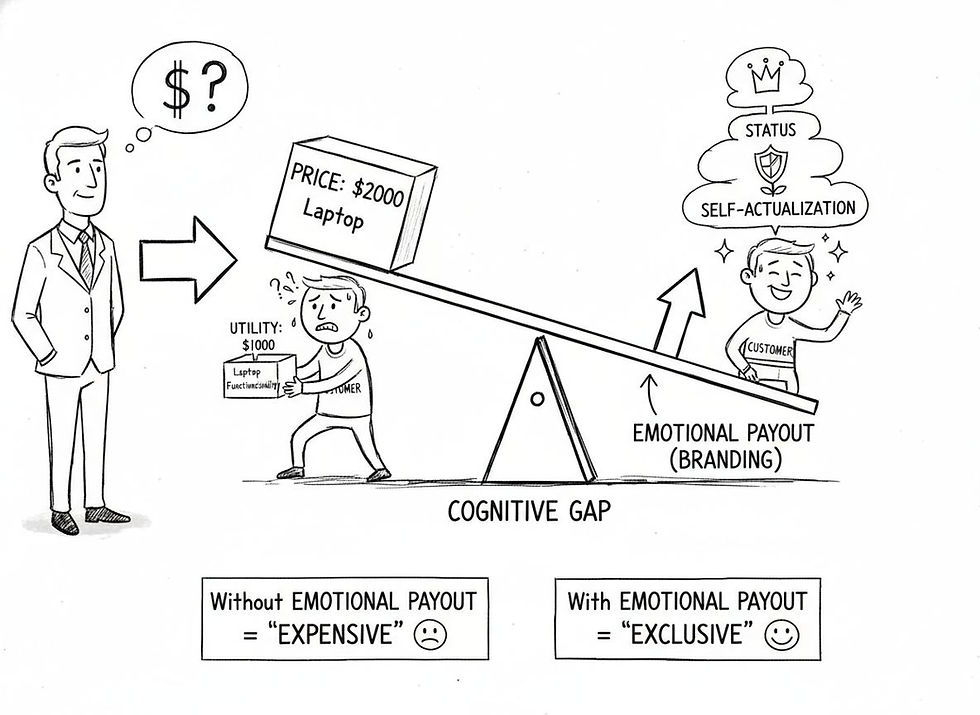

Empathy is the hedge against commoditization. When you operationalize empathy, you are not just being "nice"; you are reducing the price elasticity of your customer base. You are buying permission to make mistakes, to charge premiums, and to retain revenue during market downturns.

Deconstructing the Architecture: Cognitive vs. Affective

To scale empathy across an organization, you must first define it with architectural precision. It is not a monolith. It is a dual-process system comprising Cognitive Empathy and Affective Empathy.

1. Cognitive Empathy: The Strategic Perspective

Cognitive empathy is the intellectual ability to understand another person’s perspective. It is "perspective-taking." In a B2B context, this is the account manager’s ability to understand the internal political pressures, KPI constraints, and budget cycles of their client.

For the C-Suite, Cognitive Empathy is a data challenge. It requires dismantling information silos. If a frontline agent cannot see that a caller is a high-value client who has experienced three service outages in the last month, the agent is structurally incapable of cognitive empathy. They lack the context to "take the perspective" of the customer.

2. Affective Empathy: The Emotional Resonance

Affective (or emotional) empathy is the capacity to respond with an appropriate emotional reaction. It is the difference between saying "I see the error code" and conveying "I understand why this delay is critical for your launch."

This is where the "human-in-the-loop" strategy becomes a competitive advantage. As AI absorbs low-complexity, transactional volume, the human agent's role shifts from "processor" to "emotional regulator." Their value is no longer measured in words-per-minute, but in anxiety-reduction-per-interaction.

The Protocol of Connection: Operationalizing Active Listening

Empathy cannot be left to the personality traits of individual employees. It must be a standardized protocol. The most effective framework for this is Active Listening, applied with the rigor of a checklist.

Active listening in a high-stakes corporate environment is a three-stage tactical process:

Data Ingestion (Silence): The agent must absorb verbal and non-verbal cues (tone, pacing, volume) without interruption. This requires a suspension of the "fix-it" reflex.

Validation (Mirroring): This is the step most organizations skip. The agent must mirror the customer's emotional state before offering a solution. Phrases like "I can hear how stressful this timeline is for you" are psychological signals that lower the customer’s cortisol levels. This moves the customer from a defensive (amygdala) state to a collaborative (prefrontal cortex) state.

Strategic Response (Solutioning): Only after validation does the agent move to technical resolution.

Organizations that skip step two and jump straight to step three often fail to resolve the emotional conflict, even if they resolve the technical issue. This leads to low Customer Satisfaction (CSAT) scores despite high technical resolution rates.

The Human Capital Risk: Empathy Fatigue

A strategic approach to empathy must also account for its costs. Empathy is a finite cognitive resource. When customer service representatives are required to perform high-intensity emotional labor for eight hours a day, they are susceptible to Empathy Fatigue.

Empathy fatigue is a significant operational risk. It leads to burnout, high turnover, and a degradation of service quality where agents become robotic or cynical. From a governance perspective, this is a human capital crisis that directly impacts the P&L through increased recruitment and training costs.

The Mitigation Playbook

To manage this risk, the C-Suite must implement specific safeguards:

Rotational Workflows: Ensure high-empathy roles have "cool-down" periods or task switching to prevent cognitive overload.

Empowerment over Compliance: Scripted empathy is an oxymoron. It breeds cynicism. Governance frameworks should focus on "Guardrails" rather than "Scripts," empowering agents to use their judgment to solve problems—a strategy famously employed by Zappos, where agents are encouraged to stay on the phone as long as necessary to build a bond.

The "Whole Human" Culture: Internal empathy (management to employee) is the prerequisite for external empathy (employee to customer). You cannot export what you do not import.

Metrics that Matter: Beyond NPS

If empathy is a strategic asset, it must be measured. While Net Promoter Score (NPS) is a useful lagging indicator, it is insufficient for diagnosing the health of empathetic interactions.

Governance dashboards should prioritize Customer Effort Score (CES).

There is a direct correlation between empathy and effort. An empathetic interaction is one that anticipates needs and removes friction. A high CES indicates that the customer is fighting the system to get a result.

Furthermore, we must look at First Contact Resolution (FCR) through an emotional lens. Did we solve the problem and the anxiety? Advanced sentiment analysis (using Natural Language Processing) can now score the emotional trajectory of a call—did the customer start angry and end neutral, or start angry and end happy? This "Delta Sentiment" is the true KPI for the modern contact center.

The Boardroom Imperative

Delivering empathy is not a charity; it is a strategy. In an era where products are easily copied and prices are raced to the bottom, the emotional connection remains one of the few durable competitive advantages.

For the Board of Directors and the C-Suite, the mandate is clear:

Audit the Empathy Gap: Utilize sentiment analysis to understand where your organization is failing to connect.

Invest in "Soft" Tech: Equip your teams with the data (Cognitive Empathy) they need to understand the customer's context.

Protect the Asset: Treat your frontline's emotional capacity as a finite resource that requires management and care.

The companies that win the next decade will be those that can successfully scale intimacy. They will be the ones that recognize that while the transaction is financial, the relationship is emotional.