The Hidden Geography of Business Performance

- VangaVault Team

- 1 day ago

- 6 min read

In the 1940s, a researcher named Edward Tolman made a discovery that changed how we understand navigation. Working with rats in mazes, he realized they weren't just learning a sequence of left and right turns based on immediate rewards. Instead, they were building a cognitive map—a complex mental representation of the entire layout. They understood the terrain, not just the path.

Most CEOs today are still trying to teach their organizations to make left and right turns.

You set KPIs, you define quarters, and you incentivize specific actions. Yet, strategies fail. According to research, 90% of organizations fail to execute their strategies successfully. This doesn't happen because the financial logic is flawed. It happens because leadership fails to account for the psychology mapping of the stakeholders involved.

Business does not happen on a spreadsheet. It happens in the minds of your employees, your customers, and your investors. If you do not have a map of that territory, you are navigating blind.

This article outlines how to apply psychology mapping to solve high-stakes business problems. We will look at how to map your internal culture through Organizational Identity Architecture, how to map value using the Veblen Effect, and how to secure the future through Legacy Planning.

The Cost of Navigating Blind

We often assume that if we build a logical structure, people will follow it. We treat the organization like a machine. But an organization is a social system.

Urban planner Kevin Lynch argued that people navigate cities using mental images shaped by memory and experience, not just physical road signs. The same applies to your company. Your employees do not navigate the org chart you published on the intranet. They navigate the "shadow chart"—the unwritten map of who holds influence, where the bottlenecks are, and which behaviors actually get rewarded.

When your strategic plan conflicts with this mental map, the map wins.

This disconnect leads to "execution drift." You order a move North, but the collective psychological momentum of the firm drifts North-East. Over a fiscal year, that drift costs millions in capital misallocation.

Mapping the Internal Terrain

To fix this, you must stop viewing culture as "soft stuff" and start viewing it as Organizational Identity Architecture. This is the structural engineering of your company's psyche.

Diagnosing the identity

Many companies suffer from a fractured identity. The sales team believes the company is a high-speed disruptor. The compliance team believes it is a fortress of security. When these two cognitive maps collide, you get gridlock.

You need to audit these internal maps. This moves beyond simple employee engagement surveys. You are looking for the "landmarks" in their minds. What are the non-negotiable beliefs? What are the memories of past failures that prevent current innovation?

Aligning the Horizons

A practical way to align these maps is to overlay the Three Horizons of Growth framework with your psychology map.

Horizon 1 (Core Business): The psychological profile here must be about efficiency and reliability. The cognitive map is linear.

Horizon 2 (Emerging Opportunities): The mindset shifts to entrepreneurial, requiring a tolerance for ambiguity.

Horizon 3 (Future Business): The mindset is visionary. The map is unexplored.

Failure happens when you put a Horizon 1 manager (who relies on a map of certainty) in charge of a Horizon 3 project (which requires navigating the unknown). They will try to apply efficiency metrics to an innovation problem, killing the project before it starts. By mapping the psychological profiles of your leaders against these horizons, you ensure the right navigator is driving the right ship.

The Psychology of Value and Pricing

Once you have mapped the internal terrain, you must turn your gaze outward. How do customers map your value?

Too many firms rely on cost-plus pricing. This ignores the psychology of the buyer. Value is a perception, and perceptions can be engineered.

The Veblen Effect

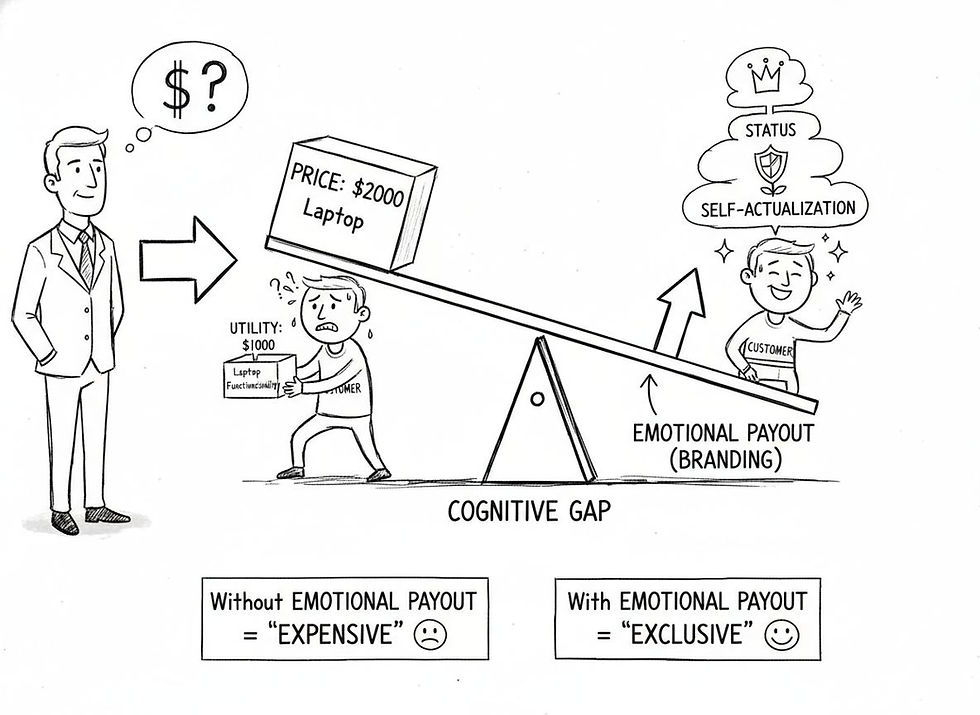

In standard economics, as price goes up, demand goes down. In luxury and high-stakes B2B markets, the opposite often happens. This is the Veblen Effect.

When you map the psychology of a premium buyer, you realize that price is not a cost; it is a signal. It signals scarcity, quality, and status. If you are consulting for a Fortune 500 board or selling high-end enterprise software, a low price does not make you attractive; it makes you risky. It damages your position on their mental map.

To leverage this, you must understand where your offering sits in the client's hierarchy of needs. Are you a commodity or a strategic asset? You cannot move from commodity to asset without changing the psychological narrative that surrounds your product.

The Peak-End Rule

How does a customer decide if they are satisfied? They do not take an average of every interaction they have had with you.

Nobel laureate Daniel Kahneman identified the Peak-End Rule. Human beings judge an experience based on two points:

The most intense moment (the peak), whether good or bad.

The end of the experience.

If you are mapping your customer journey, you do not need to be perfect everywhere. You need to identify where the "peak" emotional load is and ensure it is positive. Then, you need to ensure the "end" is flawless.

Data backs this up: 86% of buyers are willing to pay more for a great customer experience. Conversely, 32% of customers will stop doing business with a brand they love after just one bad experience. If you have a 90% smooth process but a frustrating "end," the customer's mental map of your brand will be negative.

Decision Making and Capital Allocation

The most dangerous map is the one in the CEO's head.

We like to think that C-Suite capital allocation is purely rational. But Decision Affect Theory suggests that decision-makers are heavily influenced by the anticipated emotional outcome of their choices—specifically, the regret of making a mistake versus the joy of a win.

The Fear of Regret

In many boardrooms, the fear of regret outweighs the desire for growth. This leads to safe, incremental capital allocation rather than bold bets. This is why companies sit on massive cash piles or buy back shares rather than investing in R&D. They are mapping for safety, not for the future.

We see this often in family offices. The emotional attachment to the "money made" prevents the "money invested."

This is where frameworks like EY Capital Allocation become useful, but only if applied with psychological rigor. You must force a separation between the emotional "endowment effect" (overvaluing what you already have) and the objective potential of new capital deployment.

Legacy Planning as a Strategic Anchor

For founder-led companies or family enterprises, the ultimate psychological map is the legacy.

Legacy Planning is often treated as a legal exercise—wills, trusts, and tax mitigation. This is a mistake. Legacy planning is the transfer of the founder's mental map to the next generation.

Statistics show that 70% of family businesses fail to survive into the second generation. This is rarely due to a lack of assets. It is due to a lack of shared vision.

If you transfer the assets without transferring the values (the map), the capital will dissipate. We use psychology mapping to decode the founder's intuition.

How did they evaluate risk?

How did they treat employees?

What was their "North Star"?

By codifying this into a governance framework, you ensure that the organization continues to navigate using the founder's compass, even when the founder is no longer at the helm.

The Digital Frontier and Data

We now have tools that Tolman could only dream of. We don't just have to guess what the map looks like; we can measure it.

Sentiment and Scope

New technologies allow us to perform "Digital Sentiment Analysis" at scale. We can map the collective mood of an organization in real-time. However, we must be wary of Scope Neglect.

Scope neglect is a cognitive bias where the human brain fails to scale value linearly. We care deeply about one tragic story but feel numb to a statistic of one million tragedies. In business, this means leaders often overreact to a single anecdotal customer complaint while ignoring a systemic data trend that affects thousands.

To counter this, your dashboard must present data in a way that triggers the right psychological weight. Don't just show a percentage drop in retention. Show the number of humans leaving. Make the map relatable.

How to Start Mapping

You do not need to hire a team of neuroscientists to begin. You need to start asking different questions during your strategy sessions.

1. The Audit Before you launch a new strategy, ask: "What is the current belief system of the team that has to execute this?" If the strategy requires speed, but the team's mental map prizes accuracy, you will fail unless you address that gap through Organizational Identity Architecture.

2. The Customer View Look at your pricing. Are you pricing for cost, or leveraging the Veblen Effect? Remember, consumers are willing to pay a 16% price premium for a superior experience.

3. The Long Game Are you treating Legacy Planning as paperwork, or as the transmission of your strategic DNA?

Conclusion

The market is not a math problem. It is a collection of human minds, each navigating a complex world using imperfect mental maps.

The leaders who win in the next decade will not be the ones with the most data. They will be the ones who understand the terrain. They will be the ones who recognize that culture, brand, and legacy are not soft concepts, but hard assets that can be mapped, engineered, and optimized.

Stop navigating by the chart on the wall. Start mapping the territory in the room.