CXO Branding Is a Business Asset, Not a Personal Exercise

- VangaVault Team

- 19 hours ago

- 6 min read

For decades, the board viewed executive branding as a vanity project. It was seen as a distraction for leaders who enjoyed the sound of their own voice more than the hum of operations. It was viewed as distinct from, and secondary to, the serious work of running the business.

That view is now a liability.

In today's hyper-connected market, the reputation of the C-Suite is not a sidebar; it is a core component of enterprise value. It is an intangible asset that sits on the balance sheet, influencing cost of capital, talent acquisition, and crisis resilience. We call this Reputation Capital.

When a CEO has a strong, strategic brand, the company enjoys a "halo effect." When that brand is weak or misaligned, the company pays a "trust tax."

The market does not value companies solely on earnings multiples. It values them on confidence in leadership. Research indicates that 44% of a company’s market value is attributed to the reputation of its CEO. This is the "CEO Premium." When investors believe in the person at the helm, they are more patient with turnarounds, more generous with capital, and more forgiving of quarterly misses.

Conversely, a "silent" CEO is a risk factor. If stakeholders do not know who you are or what you stand for, they will fill the vacuum with their own assumptions—usually negative ones during times of volatility. In 2025, with 61% of the global population holding a "moderate or high sense of grievance" against institutions, silence is no longer a neutral position. It is perceived as complicity or incompetence.

Organizational Identity Architecture

The most common failure mode in executive branding is misalignment. The CEO speaks about innovation, but the corporate brand signals conservatism. The CEO tweets about empathy, but the Glassdoor reviews scream toxicity. This dissonance erodes trust faster than a product failure.

To solve this, firms must employ Organizational Identity Architecture. This is the strategic process of fusing the leader's personal narrative with the corporate mission. It is not about making them identical; it is about making them harmonic.

The goal is to move beyond the superficial layer of "values" posters on the wall and engineer the identity of the firm. Your employees do not navigate the org chart you published on the intranet. They navigate the "shadow chart"—the unwritten map of who holds influence, where the bottlenecks are, and which behaviors actually get rewarded. The CEO's brand must act as the compass for this shadow chart.

When a leader consistently signals specific priorities—not just in town halls, but in how they allocate their own time and political capital—they architect the identity of the organization. If you are consulting for a Fortune 500 board or selling high-end enterprise software, a low profile does not make you safe; it makes you undefined. You cannot move from a commodity provider to a strategic partner without changing the psychological narrative that surrounds your leadership.

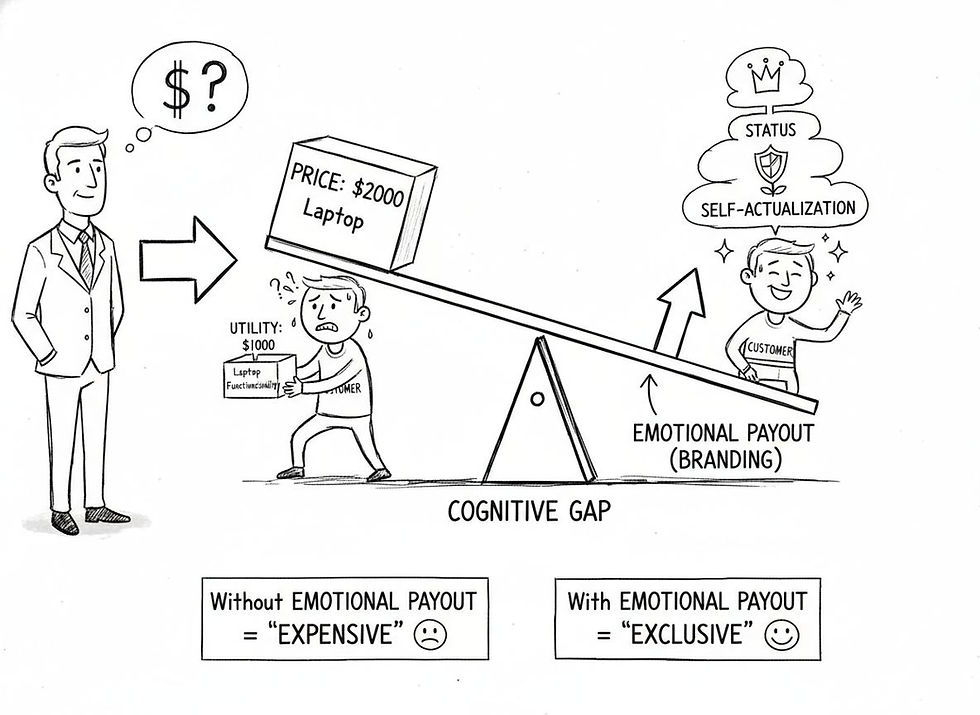

The Veblen Effect in Leadership

In standard economics, as price goes up, demand goes down. In luxury and high-stakes B2B markets, the opposite often happens. This is the Veblen Effect.

Usually applied to luxury goods like Swiss watches or designer handbags, this economic principle also applies to executive leadership. A CEO's time and attention are Veblen goods. They signal scarcity, quality, and status.

When you map the psychology of a premium stakeholder (an institutional investor or a key enterprise client), you realize that your "price"—the difficulty of accessing you, the weight of your opinion, the exclusivity of your network—is a signal of value.

If you are too accessible, too generic, or too eager to please, you lower your status. You signal that you are a commodity. By strategically curating your presence and ensuring your interventions are high-impact and scarce, you leverage the Veblen Effect. You become a "strategic asset" rather than just a "manager." This allows your organization to command higher margins, because clients feel they are buying into a premium tier of partnership.

The Fear of Regret

The most dangerous map is the one in the investor's head.

We like to think that C-Suite capital allocation and investment decisions are purely rational, driven by IRR (Internal Rate of Return) and NPV (Net Present Value). But Decision Affect Theory suggests that decision-makers are heavily influenced by the anticipated emotional outcome of their choices—specifically, the regret of making a mistake versus the joy of a win.

In many boardrooms, the fear of regret outweighs the desire for growth. This leads to safe, incremental capital allocation rather than bold bets. This is why companies sit on massive cash piles or buy back shares rather than investing in R&D. They are mapping for safety, not for the future.

A strong CXO brand mitigates this fear. When a CEO is viewed as a visionary or a steady hand, they lower the perceived risk for the board and investors. They provide "emotional cover." An investor can justify backing a risky project led by a reputable CEO because, even if it fails, the decision seemed sound at the time due to the leader's credibility.

This is the psychological utility of the CEO brand: it reduces the anxiety of capital allocation for your stakeholders.

The Talent Lighthouse

We are currently in a war for talent, particularly for high-impact roles in AI, engineering, and specialized finance. In this arena, your employer brand is insufficient. Top talent joins people, not just companies.

Candidates today research the leadership team before they research the benefits package. A visible, respected CXO acts as a "Talent Lighthouse."

Talent Density High-performers want to work with industry shapers. A CEO with a strong, articulate perspective signals that the company is a place of intellectual rigor.

Recruitment Efficiency Data from the Brunswick Group shows that by a 4 to 1 ratio, employees prefer to work for a CEO who uses digital and social media.

If your C-Suite is invisible, you are fighting with one hand tied behind your back. You are forcing your HR team to overpay for talent that a strong executive brand could have attracted organically. You are relying on headhunters to sell a story that you should be telling yourself.

Managing Scope Neglect

We now have tools that previous generations of leaders could only dream of. We don't just have to guess what the market thinks of us; we can measure it.

However, we must be wary of Scope Neglect.

Scope neglect is a cognitive bias where the human brain fails to scale value linearly. We care deeply about one tragic story but feel numb to a statistic of one million tragedies. In business, this means leaders often overreact to a single anecdotal customer complaint or one negative tweet, while ignoring a systemic data trend that affects thousands.

To counter this, your reputation management dashboard must present data in a way that triggers the right psychological weight. Don't just show a percentage drop in sentiment. Show the implication. Connect the brand metric to the pipeline velocity or the cost of debt.

You must force the board to look at the aggregate map, not the anecdotal territory. A strategic CXO brand is built on data, not on the feedback of the loudest voice in the room.

Legacy Planning as Strategy

For founder-led companies or family enterprises, the ultimate psychological map is the legacy.

Legacy Planning is often treated as a legal exercise—wills, trusts, and tax mitigation. This is a mistake. Legacy planning is the transfer of the founder's mental map to the next generation.

Statistics show that 70% of family businesses fail to survive into the second generation. This is rarely due to a lack of assets. It is due to a lack of shared vision and authority.

If you transfer the assets without transferring the values and the vision (the map), the capital will dissipate. We use branding to decode the founder's intuition.

How did they evaluate risk?

How did they treat employees?

What was their "North Star"?

By codifying this into a governance framework and a public-facing narrative, you ensure that the organization continues to navigate using the founder's compass, even when the founder is no longer at the helm. This bridges the gap between the past and the future, stabilizing the firm's identity during the most vulnerable period of transition.

De-risking via Decentralization

While the CEO Premium is real, it introduces Reputation Dependency. If the corporate brand is too reliant on one individual, you create a "Key Person Risk." If that person leaves or stumbles, the enterprise value takes a hit.

To manage this, you must treat executive branding like a diversified portfolio. Do not pin the entire corporate reputation on one savior. Build a "Constellation of Leaders."

Ensure the CFO, CTO, and CHRO also have established, credible voices in the market. This distributes the weight. It shows the market that the company's intelligence is institutional, not just individual. This protects the firm and actually increases the valuation, as it demonstrates a deep bench of leadership.

Conclusion

The era of the "faceless executive" is over. In a transparent, digital economy, anonymity is indistinguishable from irrelevance.

Building a CXO brand is not an ego trip. It is a strategic imperative. It protects market cap, attracts talent, and provides resilience in times of chaos. It requires the same rigor, strategy, and investment as any other product launch.

Your reputation is already on the balance sheet. The only question is whether you are managing it as an asset or letting it depreciate as a liability.